Everything you need to know about credit checks

What are credit scores?

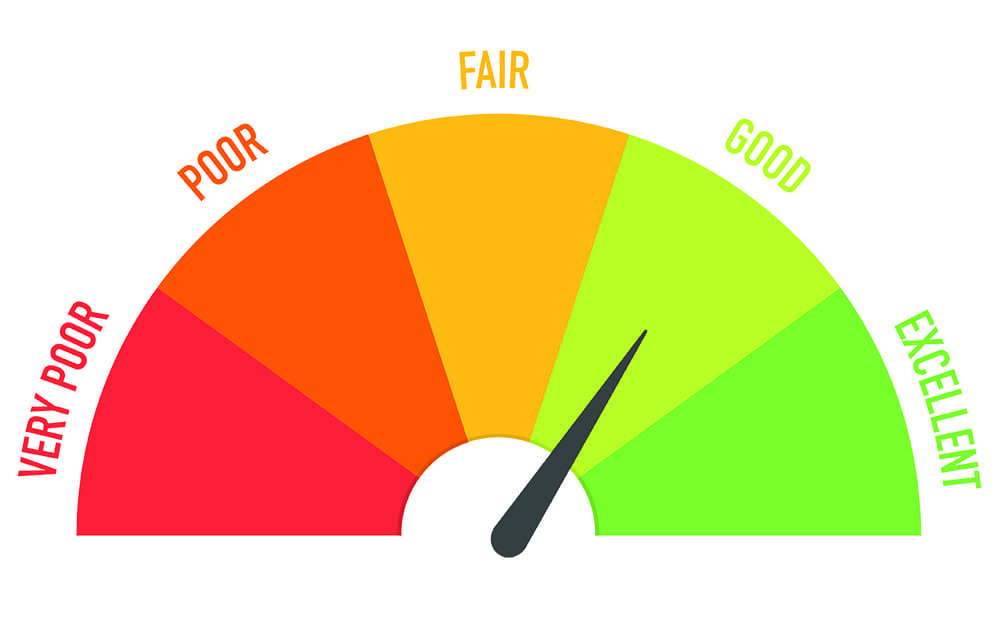

Your credit score is a number shown on your credit file and your individual number represents your ‘creditworthiness’. This number shows how trustworthy you are when it comes to paying back any credit, loan or finance that you have borrowed. The credit scale can vary numerically depending on which type of credit referencing agency you use. Many credit referencing agencies have a numerical rating which falls somewhere on a scale from poor to excellent credit.

Related – What is the lowest credit score needed for car finance?

Your credit score is important as it is an indication towards your financially history and if you can be trusted to pay back any credit in the future. Potential lenders will usually check your credit score to decide whether or not they want to offer you finance. We take into account your credit score but also other factors such as income and affordability to get you approved! Your credit score is affected by a few different main factors.

Why choose us?

- Soft search credit check

- Your own personal car finance expert

- No deposit options

- No guarantor finance

- Get any car from any UK dealership

- Flexible repayment terms

- Pay nothing for up to 6 weeks

- Fixed interest rates

Your credit score is made up of a few main factors:

- Payment history. This is probably the most important factor in credit scoring. Lenders want the assurance that you will pay back your credit or finance on time and in full, so even one missed payment on your credit file can have a detrimental effect to your score.

- Credit utilisation. It is advised that you keep your credit utilisation ratio below 50%. This means that out of the total amount of credit you have available, you should limit yourself to only using 50% of it. For example, if your credit limit was £1000, you should only use about £500 of that. Maxing out credit cards, store cards etc can decrease your score.

- Length of credit. Having credit for a long time is not a bad thing if you pay it off each month. For example, a mortgage will be recorded on your credit file and is usually paid off in 25 years (on average). However, opening multiple new accounts in a short period of time can harm your score.

Why should I check my credit?

It is recommended that you get into the habit of checking your credit file and credit score every month. Before you apply for finance, it is advised that you check your credit report. You can check your report fro any mistakes or information that is not up to date and contact your credit referencing agency to get it fixed. This can increase your chances of getting approved too. Got bad credit? Don’t worry, even if you check your file and your credit score is a little on the low side, Refused Car Finance can help!

What are credit checks?

A credit check or credit search is when a company or potential finance lender looks at your credit file to understand your financial behaviour. They will usually look at your credit score, your past credit and whether you’ve made your payments on time. When you’re applying for car finance, it can be hard to find a company that offers no credit check car finance as lenders want to know how you’ve handled credit in the past. They may also look at any financial connections you have. If you have taken out a joint car finance deal in the past or you’ve recently had finance with a guarantor, then you may be financially linked on your credit file. A credit check is usually split into two types, a hard search and a soft search.

Soft search credit check

A soft search credit check is when potential lender is able to view part of your credit file without leaving a mark. When you apply for finance with Refused Car Finance, we only provide a soft search on your credit file. We just take a quick look at your credit file to see where you fall on our scale and then along with your affordability, we match you up with the most suitable lender for you! A soft search is great as it is not recorded on your credit file and doesn’t harm your current credit score.

Hard search credit check

A hard search is performed when a lender wants to look at your full credit file. You will usually be notified on a website application form that you are about to perform a hard search that could affect your score. Each time a hard search is conducted, it is recorded on your credit file and also lets lenders know the outcome of this application e.g. whether you were accepted or declined for finance. You should also be aware that making multiple applications with a hard search in a short space of time can negatively impact your credit score. If possible, its best to stick to soft search applications only.

Apply for car finance

Ready to make a soft search application that wont harm your credit score? Apply with us today.